Social Security Tax

Social Security Tax – Social Security taxes, deducted from every check, withheld when your income reaches a certain amount. This is because of the “Social Security wage base,” which is the maximum amount of income subject to Social Security taxes. These taxes help fund the Social Security program, which provides retirement, disability, and welfare benefits for recipients.

On Thursday, along with a 3.2% cost of living increase (COLA), the Social Security Administration (SSA) announced a 5.2% increase in wages for 2024, resulting in higher taxes for Some people will pay wealth tax in future years.

Social Security Tax

In 2024, the Social Security payment will increase to $168,600 For 2023, the tax payment will be $160,200 If you earn more than $160,200 this year, you will not pay Social Security . pay tax on the amount that exceeds the limit. That can lead to a lot of money for people with more income than wages.

Social Security Tax Limit 2024: Check Maximum Taxable Earnings & How It Works?

For example, an employee whose annual salary exceeds the income of $10,000. In this case, they save $620 in Social Security taxes. On the other hand, a person who exceeds the base by $30,000 will receive a $1,860 tax break. (The more you earn, the higher your Social Security tax.)

However, Social Security payments increase each year the national wage increases. When that happens, almost every year, more income will be paid to Social Security.

Over the past five years or so, Social Security payments have increased by an average of $3,960 per year. However, in 2024, salaries will go from $160,200 to $168,600, an increase of $8,400 from last year. That’s less than a $13,200 increase from 2022 to 2023, which is the largest on record.

As a result, the top Social Security tax has increased from $9,932 to $10,453. People making more than $168,600 in 2024 will have to pay about $521 more in taxes. Social Security next year instead of what they would have been paid if the salary had remained the same. $160,200.

Tax Cut On Social Security Benefits Doesn’t Help Those Who Most Need It And Is Too Expensive • Minnesota Reformer

On October 12, along with the tax bill, the SSA announced the 2024 Social Security COLA increase. As Kiplinger reports, the more than 66 million retirees who receive Social Security checks will see their monthly government payments rise 3.2% next year.

On average, according to the SSA, Social Security retirement benefits are expected to increase by more than $50 starting in January 2024.

Some people do not have to pay Social Security taxes. (Exemptions from Social Security taxes are available if certain requirements are met.) Some examples are listed below, although there are other payroll tax exemptions for employers and employees. to finance the Social Security program in the United States. revenue is collected in the form of tax payments.

Social Security taxes are regulated by the Federal Insurance Contributions (FICA) or self-employment taxes are regulated by the Self-Employment Act (SECA). Social Security taxes are paid for the retirement, benefits, and survivors earned by millions of Americans each year under the Retirement, Savings, and Social Security Administration (OASDI). ) – called Social Security.

Increasing Payroll Taxes Would Strengthen Social Security

Social Security taxes apply to the income of employees and the self-employed. Employers often withhold these taxes from employee paychecks and send them to the government.

Social Security employee benefits are not held in trust for the current employee to pay into the account, but are used by pay seniors who are in the “pay-as-you-go” system.

Social Security also collects taxes to support individuals who are eligible for survivor benefits – benefits paid to a surviving spouse or if a spouse dies or a child survives the death of the parents.

Through 2024, the Social Security tax rate is 12.4%. Half of the tax, or 6.2%, is paid by the employee, while the other 6.2% is paid by the employee. Social Security taxes are assessed on all types of income an employee receives, including wages, salaries, and bonuses.

Social Security Benefits Tax Calculator

However, there is a limit of income above which tax cannot be applied. For 2023, the annual limit is $160,200. The limit for 2024 is $168,600.

Social Security taxes are also based on personal income, up to a certain income limit. Since the Internal Revenue Service (IRS) considers the employee to be an employee and an employee, they must pay the full 12.4% Social Security tax themselves.

Personal taxes include Social Security taxes and Medicare taxes. By 2024, the personal tax rate is 15.3% (12.4% Social Security tax + 2.9% Medicare tax). The tax is only 92.35% of the income of the business.

Ike, who owns a personal consulting business, estimates his gross income for 2023 will be $200,000 after deducting business expenses. His self-employment tax rate will be assessed at 92.35% of $200,000, or $184,700 (.9235 x $200,000).

Is Social Security Regressive?

However, since this amount exceeds the $160,200 income limit, his actual tax bill is 15.3% of $160,200, or $24,510.60 (.153 x $160, 200).

Ike can claim the above deduction for half of his employment tax, or $12,255.30 ($24,510.60 ÷ 2). As a result, he receives a partial refund of 7.65% of the employee’s portion of his employment tax (6.2% Social Security + 1.45% Medicare).

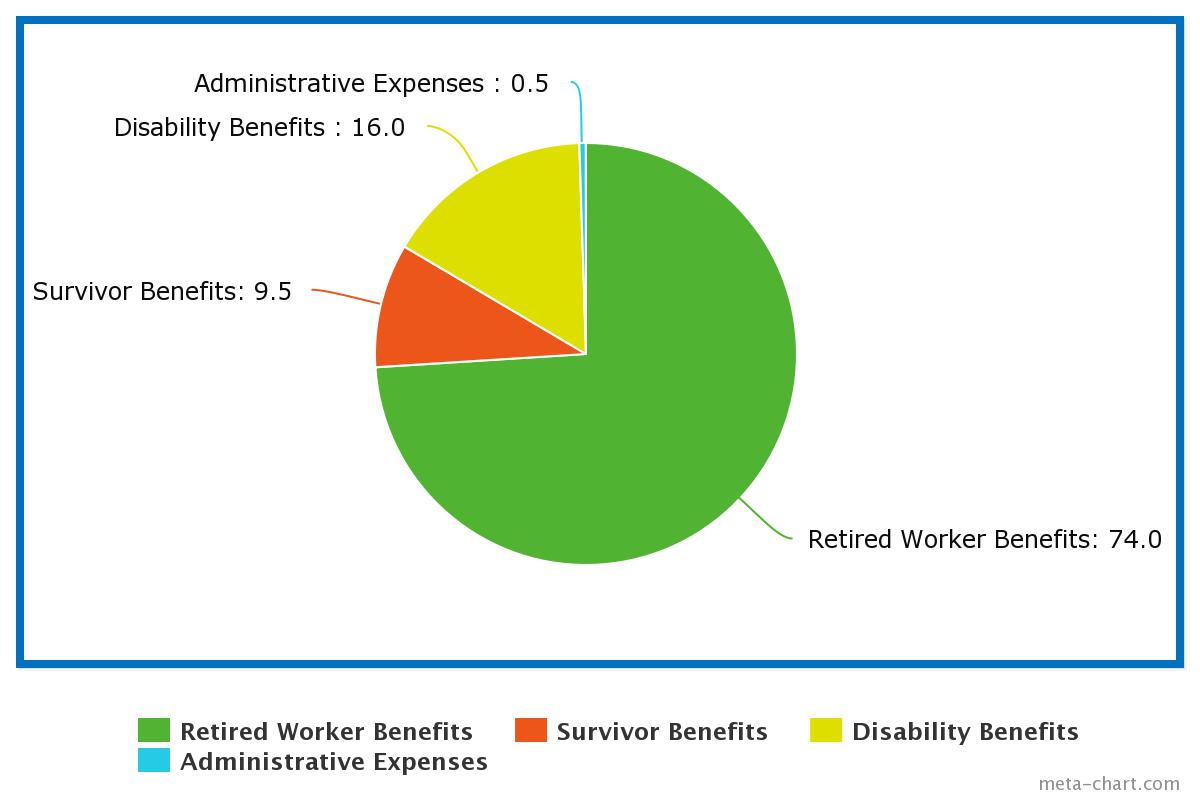

The US Department of Social Security provides financial protection to Americans against loss of income due to retirement, death, or disability. Retired workers, their families, and survivors of deceased workers receive monthly benefits. Social Security is funded primarily by taxpayers, their employers, and self-employed workers during their working years.

Not all taxpayers are required to pay Social Security taxes. Exemptions are available for certain categories of individuals, including:

Understanding Social Security Benefit Taxation

The Social Security tax is a regressive tax, which means that lower-income earners have more of their income withheld than higher-income earners. income.

Consider two workers, Izzi and Jacob. Izzy has $85,000 in income for fiscal year 2023 and has 6.2% Social Security tax withheld from her paycheck. The federal government collects $5,270 (.062 x $85,000) from Izzy to help pay for retirement and disability.

On the other hand, Jacob earns $175,000 for fiscal year 2023. His Social Security tax is only $160,200.

Therefore, Jacob will pay $9,932.40 (.062 x $160,200) as his contribution to the national Social Security program for the elderly, disabled, and disabled. But his social security tax rate is 5.7% ($9,932.40 ÷ $175,000). Izzy, who has a lower annual income, is taxed at a higher rate of 6.2% ($5,270 ÷ $85,000).

Map Shows States With Social Security Taxes In 2024

Social Security taxes are money collected by the United States government to finance the Social Security program. Taxes are collected from workers compensation, and both employers and employees contribute to the program.

In 2023, t

he income limit for Social Security taxes is $160,200 (for 2024, it is $168,600). This means that workers will no longer pay tax on any money they earn above $160,200.

If you earn between $25,000 and $34,000 in retirement income and are single, you will be paid 50% of your Social Security benefits. If you earn more than $34,000, you pay 85%. To reduce taxes, you can earn less, move income from an estate into an IRA, reduce expenses from a retirement plan, or contribute more.

Social Security is generally taxable, regardless of age. Your annual income determines whether your Social Security benefits are taxable.

Calculating Taxes On Social Security Benefits

The Social Security tax (at a rate of 12.4% in 2023) is based on the income of Americans during their working years. Income from Social Security taxes for the elderly, Survivors, and Disability Insurance (OASDI) is often referred to as Social Security.

The Social Security System, established in 1935, provides monthly financial benefits to workers when they reach retirement age, as well as upon the death of the worker (such as a spouse or children), and disabled workers.

Require writers to use relevant information to support their work. These include white papers, keynotes, original publications, and interviews with experts. We also use original research from other reputable publishers where appropriate. You can learn more about the guidelines we follow for creating fair, unbiased content in our editorial process.

The agreements shown in this message are from cooperation through receipt of payment. How this donation is affected and where the names appear. not included in all stores available.

Social Security Recipients Could Get Hit With A Surprise Tax Bill This Year

By clicking “Accept All Cookies”, you agree to the storage of cookies on your device to improve the use of the website, ensure the use of the site, and help our business. Business owners are responsible for withholding, filing, and filing taxes on their behalf. employee. And, there are other taxes that you contribute on behalf of your employees. Social Security tax is one of the most important taxes that affect both the employer and the employee.

Social Security is a mandatory tax for employees

Social security tax information, social security tax id, social security payroll tax, social security tax return, social security tax questions, tax on social security, pay social security tax, 1099 social security tax, social security tax worksheet, social security income tax, social security medicare tax, social security tax calculator

:max_bytes(150000):strip_icc()/GettyImages-1034426836-09499c825473459ab14a03672a665de3.jpg?strip=all)